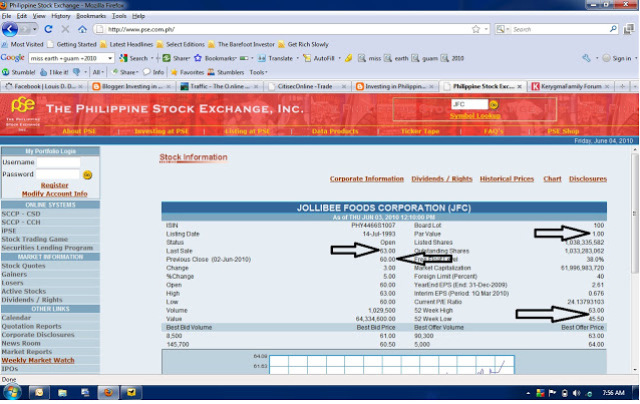

Lets check again the Philippine Stock Exchange’s website this time at the Stock information. Will use Jollibee Food Corp(JFC) as an example(again I am not endorsing Jollibee)

See those arrows? Remember my post regarding PAR VALUE, BOOK VALUE, and MARKET VALUE if not click here to read my post. In addition to that are other values per share that an investor would like to know. We call these two 52 week High and 52 week low.

These two values represent the market price range of a certain stock for a given period which is a one year. If you look at it they are far apart that is the highest is Php 63.00 and Php 45.50. From this you have an idea regarding this particular stock’s trending pattern.

It means when the market is high and the stock is active the highest or the ceiling price that one can expect is at Php 63.00. On the other hand the lowest point is at Php 45.50 when the market is down.

Now again you might ask me, “Louis why is this important?” Say example you just joined the investing bandwagon and you wanted to check out stocks; of course you wanna buy stocks at a lower price right? So check out the best companies around that is companies in good financial standing and good performance which could be done by looking at the companies Balance Sheet and Profit and Loss reports. From the list you made you will now check their current prices and match it with the two figures. You buy a stock when it is near its 52 week low. This stocks are undervalued because as you have reviewed their financial statement you will know that these are performing well but the market has valued it lower thus the term undervalued.

The 52 week high gives you an idea until were this stock can go. Always remember the principle “buy low sell high.” You are not in your right mind if you buy a stock at its highest price then sell it at its lowest price, that is insane. Remember this figures and add it to your guides in choosing the stock to invest into.

And always remember, don’t be ashamed to ask. You are the investor thus the brokers should pay well attention to you. And remember that information gives you an edge in investing.

Information is a key to the operation of today’s business. I also want to create a site where I can put company information.