source: http://www.atlasphilippines.com/

Last Friday Atlas Consolidated Mining & Development Corporation(AT) made a voluntary suspension of its shares trading in the stock market.

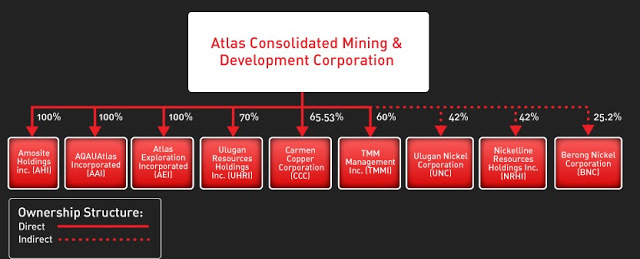

Atlas is one of the companies under the Ramos Group of the well known National Bookstore chain and Anglo Philippine Holdings. The said voluntary suspension was in connection to the reported buy out of their Singaporean partner in the Carmen Copper Corporation in Toledo City(click here for more on this). The deal is said to be at $390 million of which AT will finance through additional shares and borrowings.

source: http://www.atlasphilippines.com/

The share price of AT surged and closed on Thursday at Php 20.00; a 5.37% rise from Wednesday’s close at Php 19.24. The suspension will last up to Monday, June 27, after the company’s Board meeting regarding the structure of the said capital raising for the purchase.

source:

Carmen Copper Corporation, a subsidiary of Atlas, has contributed much of the company’s 52% increase of first quarter revenue as compared to the same period last year. Such has caught attention of most investors and the news on its buyout of its Singaporean partners to Carmen Copper even drove the price of the stock last Thursday.

Below is a graph of AT’s price surge:

Though a typical mining company with high Debt to Equity ratio due to massive capital expenditure and a deficit due to some years of non-productivity, this new event might be a possible turn arround for AT. If such Carmen Copper site will have a better than expected production and shipments of copper to their primary customers in China and Korea will be continues, price share of AT may even go further up. The suspension will be lifted up on Monday and we will see on Tuesday if such news of buyout will further make AT’s price higher.

Again fundamentally, AT have a not so good looking Current ratio and Debt to Equity due to its line of business. Technically it is about to enter overbought levels marked by its sudden price surged. If the price trend breaks out further up those who were able to get AT at Php 18.00 level will be lucky when they are able to sell such at Php 22.00 in the short term.

Ladylike Post. This post helped me in my college assignment. Thnaks Alot